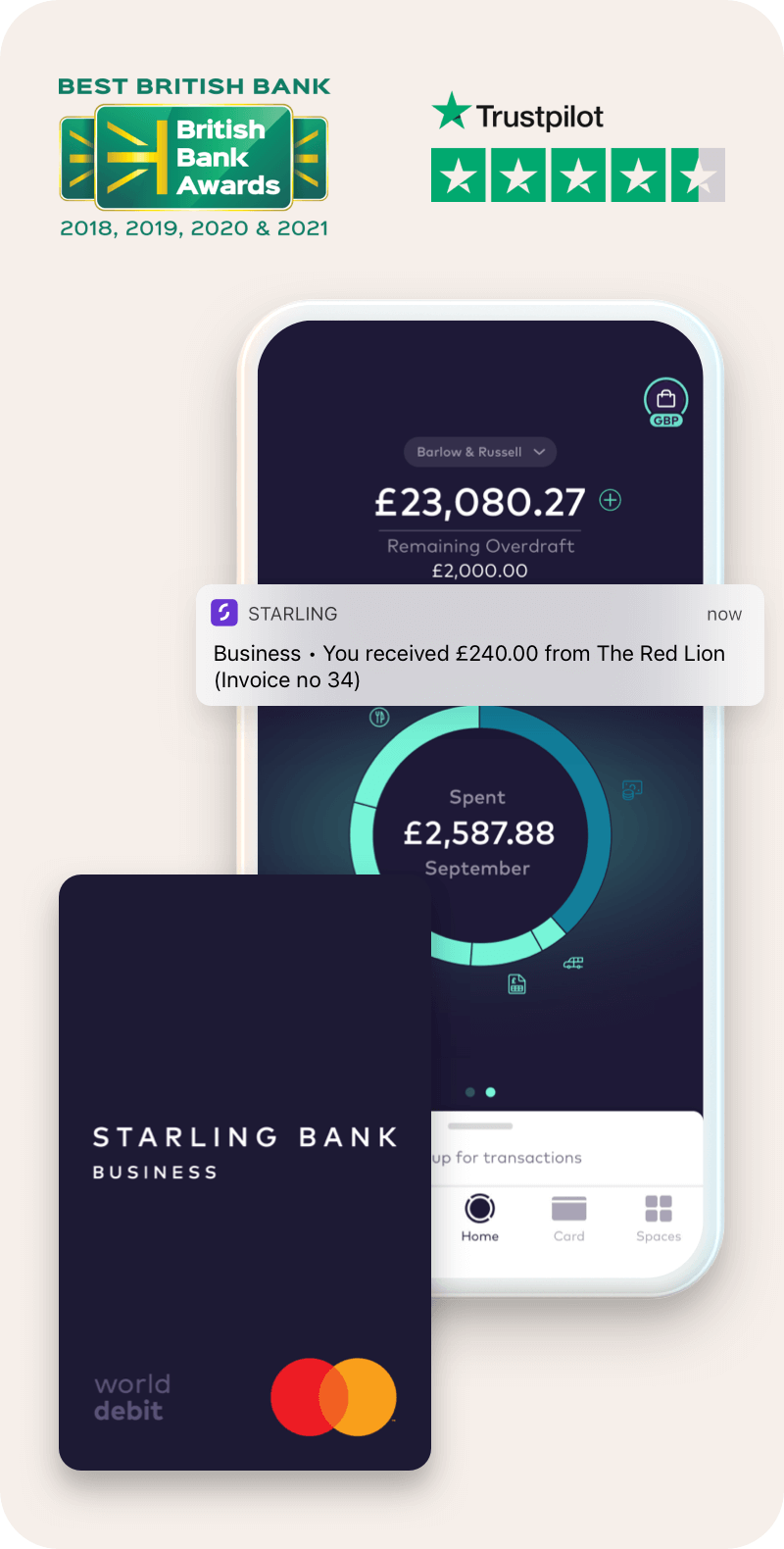

Starling Bank is an award-winning, fully-licensed, digital bank, offering a fairer and more human alternative to traditional banking. Founded in 2014 by Anne Boden, Starling has opened over 2 million current accounts and been voted Britain’s Best Bank 4 years in a row.

Business Account & Sole Trader Account

Over 400,000 businesses are managing their finances with Britain’s Best Banking provider 2021.

- No Monthly Fees

- UK team are available for 24/7 support

- Real-time integration with Xero, Quickbooks or FreeAgent

- Instant payment notifications

- Spending analytics and receipt capture

- Quick and easy application from your mobile phone

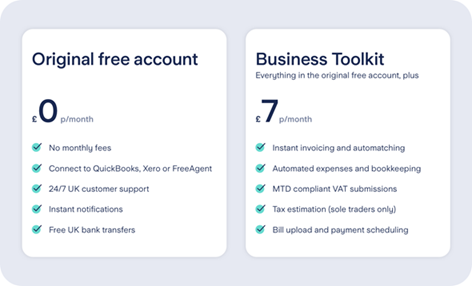

- Upgrade for £7 a month to Business Toolkit, to save time on bookkeeping, invoicing and tax

- Grow your business overseas with Euro (£2/mth) and USD accounts (£5/mth) and low cost and transparent international transfer fees

HOW WE COMPARE

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1200 customers of each of the 14 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

Your banking and bookkeeping all in one place

Manage your invoices, bills, tax, VAT and more from your bank account, all for just £7 a month with the Business Toolkit, find out more here.

Starling Marketplace

The Starling Marketplace offers a range of smart integrations to help you manage your business by connecting your Starling app with your favourite products and services, from your accounting software to your payments platform:

- Save time and personalise your business banking to suit you

- Share your banking data with your accounting software, securely and automatically in real time

- Link your Starling app to leading point-of-sale platforms, Zettle and SumUp. You can receive detailed summaries on your incoming payouts including transactions, fees and VAT

To find out more, click here.

What you will need to open an account

- A smartphone (and signal) – Starling does everything through their app!

- Valid photo ID such as a passport or UK driving licence.

- If you’re opening a business account you’ll need to be a sole trader or the PSC of a Limited Company (LTD) or Limited Liability Partnership (LLP).

- About 10 minutes of your time (if you have documents which confirm the nature of your business at hand this will be easier – some examples are available here).

- If you already have a personal account and want to open a business account or sole trader account, simply click on the button in the top right hand corner of the Starling app, select your personal account and then click “Open a new account”. You’ll then be prompted to answer some questions about the business you’re opening an account for.

Follow Company Bug