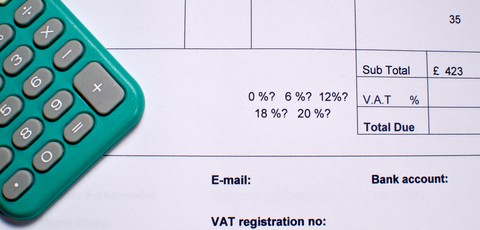

Value Added Tax is charged on almost all products and services provided in the UK. The current standard rate is 20%. If your business becomes VAT-registered, you will charge VAT on all invoices you submit to your clients.

Each quarter, you work out how much VAT you have collected on behalf of HMRC, subtract any VAT owed to your business (if relevant), and then pay the difference back to HMRC.

Do you need to register?

If you are running a business, and expect to turnover £85,000 or more over the next 12 months, then you must register for VAT (for the 2019/20 tax year).

For professional reasons, or in order to claim back the VAT you have to pay out from your business, you may decide to register for VAT even if your turnover has yet to reach the current mandatory threshold.

Which VAT scheme is right for you?

HMRC operates several types of VAT scheme:

1. The ‘standard’ scheme which applies to most business, where you calculate for input and output VAT at the current 20% ‘standard’ rate.

2. The ‘cash accounting’ scheme allows you to only account for VAT once you have received payment for invoices, otherwise VAT becomes payable the moment an invoice is raised. This is very similar to the standard way of accounting for VAT, but can provide extra cash flow benefits to small businesses.

3. The ‘Flat Rate’ scheme, which provides a simpler way to account for VAT and may be beneficial depending on your personal circumstances.

The Flat Rate scheme was created to cut down the time small companies spend on accounting. Rather than accounting for every transaction you make, you simply apply a flat rate VAT percentage to your turnover.

Although you cannot claim back the VAT on purchases via this scheme, you are allowed to account for one single large purchases (over £2,000), or a number of items totalling over £2,000, if they are bought in the same transaction.

In addition, you receive a 1% discount on the flat rate in your first year of trading.

Find out more in our guide to the flat rate VAT scheme.

How do you register?

Your accountant will typically set up your VAT registration for you.

Otherwise, you can complete Form VAT 1 and return in to HMRC, or register online (which is the most efficient route to take).

After a few weeks, you will receive a unique VAT number which you will use on all your invoices and company paperwork. Be aware that delays to VAT registration are not uncommon.

For more information, read our article on how to register for VAT.

How do you pay VAT?

For both the standard and Flat Rate schemes, you must complete a quarterly VAT return. You complete the return and submit your payment online. If you set up a direct debit, not only is this a time saver for you, but you also get an extra week before the money comes out of your account.

Depending on your accountant’s service, you may or may not be required to submit your quarterly returns yourself. Always consult your accountant if you have any questions about registering for, or accounting for VAT.

More on how and when to register for VAT for your limited company and limited company tax.

Follow Company Bug