Whether its clients “forgetting” to pay, stalling for time before settling their bill – or sometimes just deciding not to pay you at all – having to chase up money that’s rightfully yours is frustrating and time-consuming.

The problem of late payment is more widespread than you might think – the UK government estimates that small firms are currently owed around £26bn in late payments, while the process of chasing debts costs these businesses millions of pounds more.

Last year, online accounting provider FreeAgent carried out a poll with YouGov that found almost one in four (23%) small business owners had waited at least six months after their payment deadline to be paid by a client. Their other research carried out among UK web designers and developers also revealed that a staggering 97% has had to deal with a late payer at one point or another. Many said that they even had to write off thousands of pounds due to not being paid at all by a client.

But how can you influence something that seems to be out of your control? FreeAgent’s Data Team has been investigating the effects of different invoicing terms on payment times and the results were surprising; if you usually give clients 30 days to pay, FreeAgent data shows that some clever tweaks to your terms could make you three times more likely to be paid within a week.

How many invoices are actually paid on time?

In its research, FreeAgent wanted to find out if there was anything that freelancers and small businesses could actively do in order to get paid more quickly.

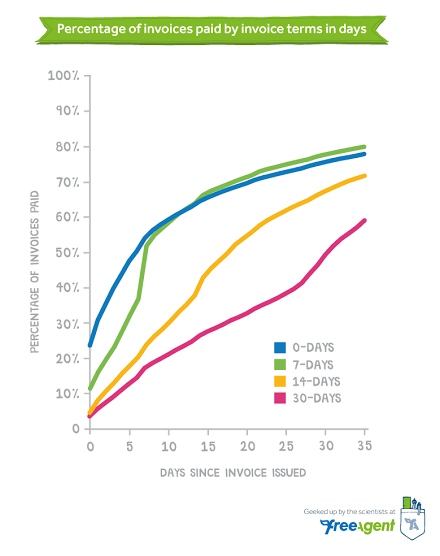

The data team started by looking at FreeAgent invoices from 2015 with different common payment terms (30-, 14-, seven- and zero-days) and comparing how often these invoices were paid “on time” (meaning before the invoice term expires).

They found that 46% were paid within 30 days, 38% were paid within 14 days, 37% were paid within 7 days and 24% were paid immediately. This suggests the longer the terms, the more chance of being paid within these time periods. But how many days did it actually take for these invoices to be paid?

Zero-day invoicing terms get the quickest results

The stats seem to suggest that it looks like the most effective way to be paid on time is to have a 30-day payment period. But when FreeAgent looked specifically at how many of these 30-day invoices were actually paid in less than seven days of being issued, the results were surprising:

50% of invoices were paid immediately, 36% of invoices were paid within 7 days, 21% were paid within 14 days and 15% of invoices were paid within 30 days.

So, if you tell your client to pay you immediately you’re more than three times as likely to be paid within a week than if you use 30-day terms.

Cut your invoice terms and the hassle of chasing payment

So, while setting longer terms may mean you’re more likely to be paid “on time”, if you’re actually looking to get the money you’re owed quickly, it turns out that setting either a seven-day or a “pay immediately” zero-day term could work much better for you.

FreeAgent’s results show that with shorter terms, you’re more likely to get the cash owed to you within a week and will be less likely to have to worry about chasing up outstanding invoices – so you can get on with running your business.

FreeAgent provides multi-award winning cloud accounting software for freelancers, contractors and small businesses. Try it for free at www.freeagent.com.

Follow Company Bug