Your new business may have a promising product and high-value clients, but if they don’t pay for your goods and services, then your venture could quickly fail. Therefore managing your small business invoicing is a vital part of running any business. Having a comprehensive understanding of what needs to be included in an invoice and common billing mistakes can also benefit your cash flow.

While it’s every business owner’s dream to be paid immediately, payments are often delayed by inaccurate or incomplete invoices. Indeed, Sage Business Cloud Accounting recently conducted a study which found that around 17% of all payments to SMEs are late and on average these companies spend 15 days a year chasing late payments.

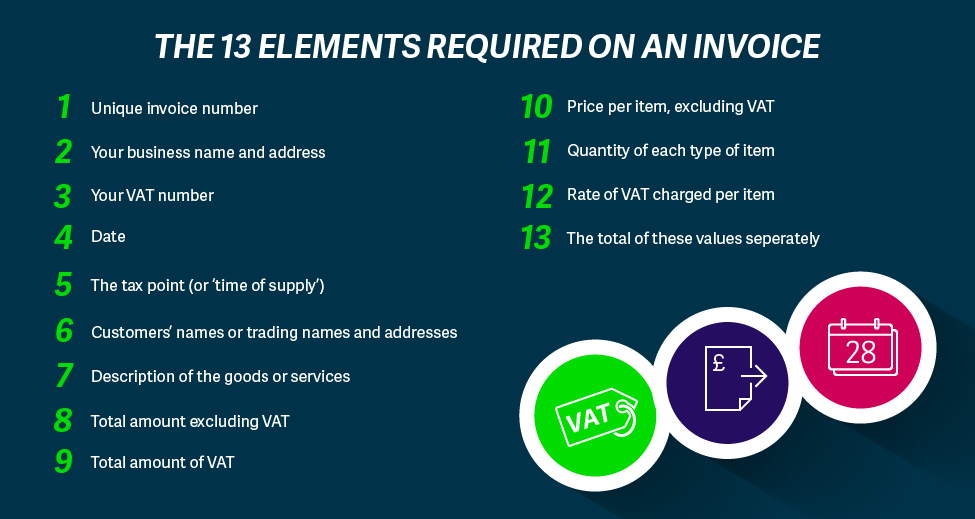

These are the 13 essential elements that are needed on an invoice for it to meet VAT regulations:

Invoices can contain all of the above elements, but still be difficult to understand due to other oversights. Here are some of the most common mistakes:

Spelling and formatting errors

If you make spelling mistakes errors or send a badly formatted invoice, you’re giving your clients an easy excuse for delaying payments. Some clients might also have specific invoicing procedures or need additional information to complete payments. Following a template or using accounting software can help keep your invoices looking professional and accurate.

Unexplained fees

Your invoices should be itemised and not include any unexplained fees. The services you provided and all costs should be accurately described on the invoice, so the client can easily understand exactly what they’re being charged for. Within reason, the more information you give, the easier it will be for them to pay you.

Unclear payment terms

Establish clear payment terms with your clients at the start and include these on the invoice. Payments can be made easier if you offer a variety of ways to pay and include these within the terms.

A ‘payment due by’ date should also feature on every invoice you send. This should be an actual date and not just “30 days upon receipt” because those deadlines are easy to forget. Don’t be afraid to send a reminder before the payment is due and to chase regularly if the payment is late. This helps set a precedent for getting paid on time.

Sending to the wrong person

Similarly, you should have a clear idea of which person or department the invoice should be addressed to. An invoice sent to the wrong person can easily get lost – not to mention the fact that it looks unprofessional. Try to maintain a personal connection with those dealing with your payments as this can move your invoice higher in the pile and will make it easier to chase.

You’ve done the hard work selling your product or service, so don’t undermine all that work by sending substandard invoices. Getting your billing right is essential to cash flow. An invoice that’s detailed, accurate and professional will help make payment easy for your client and encourage them to pay promptly.

For additional tips on managing cash flow, dealing with late payments and strategies for growing your business, check out Sage’s Ultimate Guide to Basic Business Accounting.

More on late payments and accounting software.

Follow Company Bug