Investing in one’s own business comes with a high risk of not achieving the expected results. The level of competition in the UK’s market is high: since 2015, more than 500,000 start-ups have been launched every year. In the first six months of 2018, more than 300,000 new companies have been registered.

Each entrepreneur faces many challenges from the very beginning of his or her journey, especially in regards to financing their business. While some businesses are fortunate enough to acquire investors, the majority have no choice but to get a start-up business loan. Here Market Inspector highlight how start-ups can benefit from business accelerators.

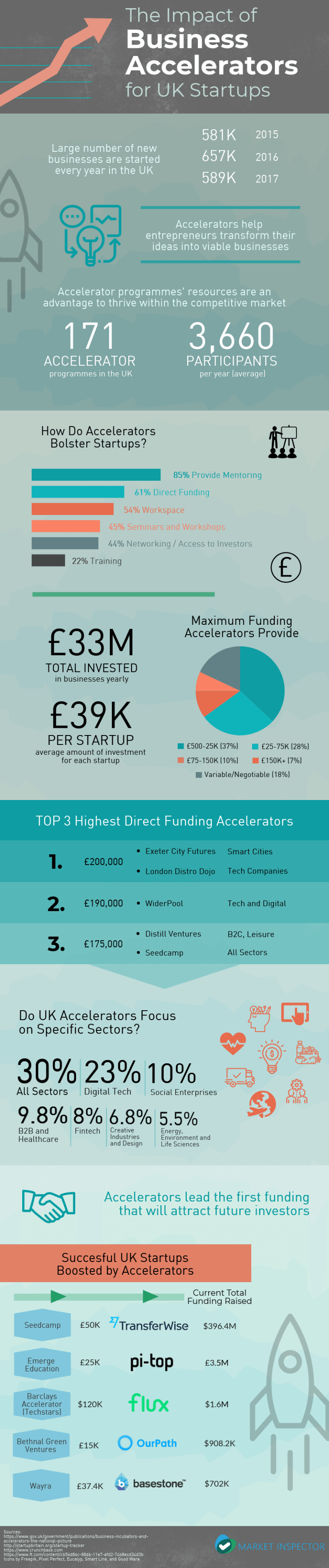

Entering a business accelerator programme may be a great chance for newly-opened businesses. Currently, there are 171 programmes registered in the UK. On average they invest £39K per startup, but if the idea is really promising, this number may be raised to as much as £150K+.

The importance of business accelerators on the UK market

The main purpose of business accelerators is to bolster new businesses, irrespective of the market area chosen by the entrepreneurs. According to the British Department of Business, Energy and Industrial Strategy (BEIS), accelerators offer support from 3 to 12 months, and most of them provide seminars and workshops (45%), office workspace (54%), direct funding (64%), and mentorship (85%).

One of the biggest and most successful programmes accessible on the UK market is Techstar. The programme has been active since 2006, and its success rate is very high. Over 76% of the start-ups participating in Techstar’s programme are still active on the market.

Business accelerators have uplifted some very successful start-ups, such as Transferwise, which has raised £300M, Pi-top (£3.5M), Flux (£1.2M), OurPath (£683.2K), and Basestone (£532K). Accelerators have a big influence on the future success of a company, by leading the first funding rounds that will attract future investors.

Start-up accelerators are on the rise

The popularity of business accelerators has significantly increased over the last few years, which could be attributed to the growing number of start-ups. The programmes are mostly financed by private capital, as well as public funds; 59% from private investments vs. 41% from official and governmental institutions and agencies.

Some individual companies see creating business accelerators programmes as long-term investments. The biggest and most successful brands like IKEA, Virgin, Just Eat, and Deliveroo have decided to launch their own accelerator programmes to boost innovation in market areas that are aligned with their interests.

Amongst all UK cities, London is undoubtedly the one with the highest density of business accelerator programmes. However, the number of start-ups has also significantly increased in Scotland and Northern Ireland. This reveals opportunities for entrepreneurs from all over the United Kingdom.

Market Inspector has created an infographic illustrating the impact of business accelerators for UK Start-ups.

More on small business finances and small business funding.

Follow Company Bug